DISCLAIMER: The analysis and points for discussion of this paper do not necessarily reflect the views of the Tsinghua University, its Executive Board or its subsidiary schools. The points for discussion of the paper are solely the views of the author(s) and do not reflect the views of any government or organization.

All rights reserved. Any part of this publication maybe quoted, copied, or translated by indicating the source. No part of this publication may be used for commercial purposes without prior written permission from the author(s).

Authors: WANG Bolu[1], CHEN Yunhan[2]

[1] Corresponding author: Senior Research Fellow at the Center for Green Finance Research, The National Institute of Financial Research, Tsinghua University

wangbl@pbcsf.tsinghua.edu.cn

[2] Former researcher at the Center for Green Finance Research, The National Institute of Financial Research, Tsinghua University

For more details about the research, please click the link below:

https://cloud.tsinghua.edu.cn/f/cebc6b482e2a4aef8600/

If you have any interesting questions or enquires, please contact the editor as

yangsy@pbcsf.tsinghua.edu.cn

We are looking forward to your message.

Related Reading:

Green Finance Burgeoning in Emerging Markets:Mongolia

Source: https://cloud.tsinghua.edu.cn/f/92f1196603d94fe2b487/

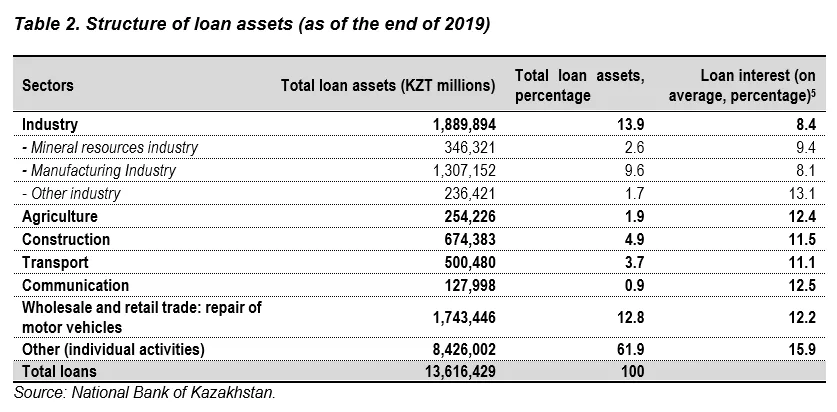

Table of Contents

Acknowledgements

The authors would like to thank the Astana International Financial Centre for facilitating the field research and coordinating interviews in the country. The authors are grateful for useful information provided by Alexandr Belyi, Assel Nurakhmetova, Sam Jianqiang Wan, Aigul Kussaliyeva.

Executive Summary

In 2015, 17 Sustainable Development Goals (SDGs) and 169 targets were globally agreed to address development challenges in three dimensions: economic, social and environmental. Eight goals are directly related to environmental protection, climate change mitigation and adaptation, indicating a strong global pledge to protect our planet for future generations. With only 8 years to 2030, the endpoint of the goals, the world is facing an unfolding environmental crisis, exacerbated by the severe social and economic impacts caused by COVID-19. Biodiversity is in steep decline, and climate disruption is approaching a point of no return. As countries look for ways to recover, there is an opportunity for reflection on past economic development models and to take bold actions to transition to a greener and more sustainable economy.

Collaborative efforts of stakeholders across all of society and across countries are needed to make the necessary rapid and far-reaching transitions a reality. Leveraging private capital in particular holds great potential to contribute to the efforts, as demand for funding the transition is far higher than the available fiscal space of any single government, particularly in developing countries. Furthermore, investors increasingly looking for green investment opportunities are generating positive feedback loops and opening up space for collaboration among the public and private sector to build a sustainable enabling environment.

The paper seeks to set the stage for a discussion on green finance to explore the key factors driving green development, progress made so far and the way forward, as well as relevant policies and sustainable investment opportunities. The discussion would also cover the options and actions that could further facilitate and incentivize the inflow of private capital into local green sectors in countries with similar contexts and priorities as Kazakhstan.

This paper uses foreign lending and investment data from the following sources: (1) officially published economic data of the targeted countries, (2) China outbound investment data in the China Global Investment Tracker database published by the American Enterprise Institute, and (3) project-level environmental information on China’s direct investment projects available in online media outlets. The data and analysis in this paper can be helpful for discussing and stimulating evidence-based dialogue and knowledge exchange among countries that face similar challenges in green development, leveraging the emernging-market knowledge-sharing networks and expertise of the target country.

Applying similar methodology used by the authors in the previous paper on Mongolia, China’s Green Industry Guidance Catalogue was used to assess the ‘greenness’ of inbound financial flows to Kazakhstan. Following the analysis of the financial sector landscape in Kazakhstan and foreign financial flows and their level of “greenness”, this paper presents potential investment opportunities that make good economic sense and contribute positively to countries’ green development agenda.

In Kazakhstan, opportunities for green finance have started to emerge in key sectors, including sustainable infrastructure, water efficiency, energy efficiency and renewable energy. The paper concludes with some selected relevant themes for further discussion, with the aim to promote a dialogue among all stakeholders including investors on green transformation, on how to further incentivize green capital. The paper emphasizes the importance of effectively engaging all relevant stakeholders, notably the private sector, in achieving significant transformational change in the field.

In Kazakhstan, points for consideration include the identification of a key national green development champion, possibly a governmental entity that could commit to and lead green finance development; leveraging collaboration networks with local and international green finance pioneers for knowledge sharing; capacity building; and levelling the playing field between fossil fuel-based and green activities combined with a re-examination of fossil fuel subsidies.

Some Important Figure (Table)

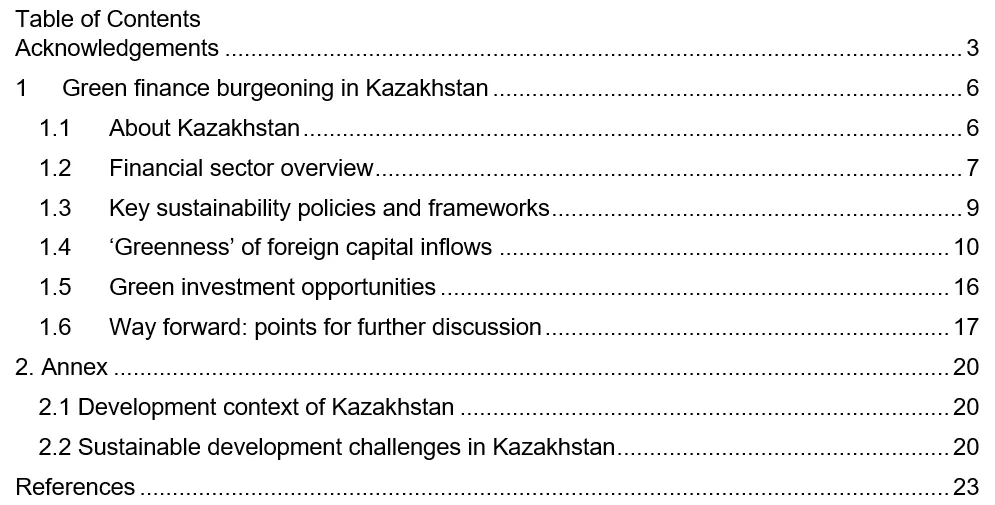

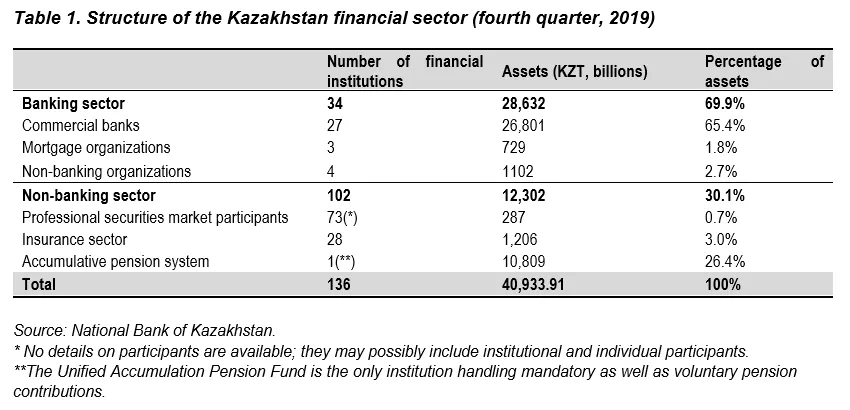

1.2 Financial sector overview

1.4 'Greenness' of foreign capital inflows

1.5 Green investment opportunities

(1) Sustainable infrastructure development

(4) Renewable energy

1.6 Way forward: points for further discussion

To further incentivize green capital inflows, improvements can be made in areas include:

(1) Elaborating the level of consensus and forming effective coordination among national government stakeholders, as well as identifying a governmental leading entity in advancing green finance development;

(2) Providing a level playing field between fossil fuel-based and green activities and reexamining the massive and recurrent fossil fuel subsidies;

(3) Developing a national green taxonomy that facilitates domestic and international green investment;

(4) Increasing the supply of affordable funding for green projects, especially capital-intensive ones; and

(5) Investing human capital, especially qualified technical experts in government agencies and regulators for developing green financial policies and products.

More capital flows from domestic and foreign investors directed to key green industries would help support Kazakhstan’s sustainability strategy and effective transition to a low-carbon economy.

Editor: YANG Suyu